Most Illinois tax professionals can tell at a glance whether a small business is at risk for an Illinois sales tax audit. Here are some of the reasons. There have been ongoing changes in the work people do and the way in which they do it, which have been brought to the forefront do to changing technology. Covid, of course accelerated all of this, pushing us off of an edge into the world of "work from home" and dramatically changing the way people did their jobs before most of us had a chance … [Read more...]

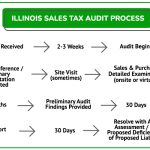

A Few Things To Know About State of Illinois Sales Tax Enforcement and Audit Techniques for Small Businesses.

Bankruptcy Filings Down 55% in Northern District of Illinois.

In the Northern district of Illinois, Bankruptcy filings in April of 2021 are down 55% from April of 2019, the last year for which filings were not affected by the pandemic. The April figures continue the trend of bankruptcies being down for this calendar year (by 54% through April 30th) when compared to 2019. Difficulties in pursuing credit and collections lawsuits in through the Illinois courts, limitations on moving forward with foreclosures and evictions, and the effects of government … [Read more...]

Tax Changes That Will Impact You in 2015

The IRS has announced additional changes to the tax code that will take effect in 2015. The most significant changes for most taxpayers are in the areas of retirement income. The limit for 401 (k) contributions will increase by $500 from $17,500 to $18,000. According to U.S. News & World Report, even that small increase in the contribution limit could yield an additional quarter million dollars for taxpayers if invested at 8 percent over a 25-year period. Taxpayers will also see an increase … [Read more...]

Extenders Legislation Won’t Stop Tax Season from Opening Jan. 20

The IRS announced this week that legislation passed by Congress to extend expired tax breaks will not impact their ability to open tax season as planned on Jan. 20 for both electronic and paper filers. The federal tax authority had previously announced that tax season would not open to 1040 paper filers until Jan. 30. That is no longer the case. IRS Commissioner John Koskinen said this week, “We have reviewed the late tax law changes and determined there was nothing preventing us from continuing … [Read more...]

Renting Still More Expensive Than Buying — Except Where Most Millennials Live

A new report released last week from housing data expert RealtyTrac reveals that in 2015 it will be more expensive to rent than buy in most real estate markets nationwide. According to the report, renting a three-bedroom property next year will require an average of 27 percent of median household income. Buying will require only 25 percent. The exception to this finding is in the 25 areas where the population of millennials has increased significantly. In those areas, renting will require 30 … [Read more...]

Is It Smart to Secure a Credit Card After Bankruptcy?

If you have recently filed for bankruptcy, a credit card is probably the last thing you want in your wallet. However, when it comes to repairing your damaged credit history, a credit card—used responsibly—can actually be one of your greatest allies. According to Investopedia, people often receive dozens of credit card offers within weeks of finalizing their bankruptcy. That’s because creditors know you can’t file for bankruptcy again for at least two to eight years. Most of these offers are for … [Read more...]

Top 10 IRS Tips for Choosing a Tax Preparer

With more than half of all taxpayers electing to have a tax preparer file their return, the IRS is weighing in on what people should consider when choosing tax preparation services. According to the federal tax authority, “Well-intentioned taxpayers can be misled by preparers who don’t understand taxes or who mislead people into taking credits or deductions they aren’t entitled to in order to increase their fee.” To help prevent taxpayers from getting duped, last week, the IRS shared 10 tips … [Read more...]

East Cleveland Considers Chapter 9 Bankruptcy

Distressed Illinois municipalities are not the only ones looking at Detroit and questioning whether bankruptcy is a viable option to help them turn things around financially. East Cleveland, Ohio has announced that bankruptcy may be its only option. According to Reuters, Ohio’s state auditor revealed this month that the city is insolvent and on the verge of collapse. Among a host of problems, cell phone service for the city’s workers was involuntarily disconnected recently because of the city’s … [Read more...]

Zillow’s “Coming Soon” Listings Have a Disappointing Start

Excitement about Zillow’s much-talked-about “coming soon” listings seems to have died as quickly as it started. According to Re/Max Legends Associate Broker Hank Bailey, one of the many issues with the new listing type is that buyers already have a lot of active listings to consider. Another problem Bailey cites in a new article forInman News, is that sellers and agents cannot properly market “coming soon” properties because they are not ready to photograph. “It might whet the buyers’ curiosity … [Read more...]

Upside Down Mortgages Becoming Less Common in Most Major Markets

The number of homeowners nationwide who owe more on their mortgage than their home is worth is down by more than 40 percent, according to Zillow’s latest negative-equity report. Since 2012, more than 7 million homeowners have been able to restore balance to their negative home equity through improvement of their home’s property value, short sale, foreclosure, or by paying down their mortgage balance. Despite this encouraging shift, however, approximately 8.7 million homeowners are still upside … [Read more...]