Most Illinois tax professionals can tell at a glance whether a small business is at risk for an Illinois sales tax audit. Here are some of the reasons. There have been ongoing changes in the work people do and the way in which they do it, which have been brought to the forefront do to changing technology. Covid, of course accelerated all of this, pushing us off of an edge into the world of "work from home" and dramatically changing the way people did their jobs before most of us had a chance … [Read more...]

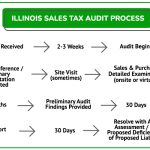

A Few Things To Know About State of Illinois Sales Tax Enforcement and Audit Techniques for Small Businesses.

Bankruptcy Filings Down 55% in Northern District of Illinois.

In the Northern district of Illinois, Bankruptcy filings in April of 2021 are down 55% from April of 2019, the last year for which filings were not affected by the pandemic. The April figures continue the trend of bankruptcies being down for this calendar year (by 54% through April 30th) when compared to 2019. Difficulties in pursuing credit and collections lawsuits in through the Illinois courts, limitations on moving forward with foreclosures and evictions, and the effects of government … [Read more...]

Flashy Instagram Pics Land ‘50 Cent’ Back in Bankruptcy Court

A bankruptcy judge has ordered rapper Curtis J. Jackson III, also known as “50 Cent,” to appear in court to explain a series of flashy Instagram photos that feature the bankrupt entertainer surrounded by several dozen stacks of 100-dollar bills. Jackson filed Chapter 11 bankruptcy back in July with more than $30 million in debt owed to creditors. The social media images have caused those unpaid creditors to question his inability to pay. At a hearing last week, the judge seemed to have questions … [Read more...]

7 Types of Income You Don’t Have to Pay Taxes On

Now that tax filing season is among us, we are all keenly aware of all the ways the IRS can tax our income. But did you know that certain income is actually exempt from taxing? According to a recent article in U.S. News & World Report, there are seven types of income Uncle Sam will not tax. One of those forms of income is child support. Provided it is not classified as an alimony payment, child support is not taxable. Another form of income the IRS will not take a bite out of is a life … [Read more...]

Real Estate Paperwork 101: 19 Docs You Need to Buy (or Sell) a Home

It’s no secret that real estate purchases involve a mountain of paperwork that can often overwhelm both buyers and sellers. If you are planning to buy or sell a home in the coming months, you can avoid unnecessary stress by understanding all the docs needed to close and start collecting the items you can now. A new Trulia article provides a comprehensive list of 19 docs both buyers and sellers need to provide to make the real estate deal go as smoothly as possible. Some of the items buyers need … [Read more...]

5 Signs You Should Walk Away From a Real Estate Deal

When you finally find a home you really love, it can be difficult to walk away once the deal starts to look less than ideal. But according to the real estate experts at Zillow, there are five clear warning signs you should never ignore. One major red flag is when the inspection report reveals a variety of issues that make your dream home look more like a fixer upper. Another problem that should give you serious pause is if the appraisal comes back for less than the contract amount. To learn … [Read more...]

What’s the Ideal Credit Score to Buy a Home?

It’s no secret that banks have become increasingly strict about handing out mortgage approvals since the housing crisis. Now,more than ever, a prospective homebuyer’s credit score is under intense scrutiny by banks. So exactly what score do lenders find ideal? According to an article posted this week on Realtor.com, a score in the 740 range gives borrowers the highest likelihood of securing a conventional loan. A lower credit score is not a deal breaker, but in most cases, borrowers will be … [Read more...]

4 VA Loan Myths that Keep Veterans Renting

With industry-low interest rates, VA loans are an excellent way for veterans to realize the American dream of homeownership. However, millions of eligible veterans are still renting, in large part due to longstanding myths and misconceptions about VA loans. According to Zillow, there are four common myths that keep vets from taking advantage of this hard-earned benefit granted to them by the GI Bill of 1944. One of those misconceptions is that an excellent credit score is needed to qualify. The … [Read more...]

IRS Hardware Failure Shuts Down E-File System

Taxpayers who e-filed a tax return this week may experience delays in processing their refund due to a system outage on Wednesday afternoon at the Internal Revenue Service. According to USA Today, a hardware failure has caused the agency to stop accepting electronically filed returns. While the website, irs.gov is still functioning properly, features like “Where’s My Refund” and other services are not working. In a statement the agency said, “The IRS is still assessing the scope of the outage. … [Read more...]

Income You Should Report on Your Taxes–But Likely Don’t

As you get ready to file your taxes this season, keep in mind that income from your employment is not the only income the IRS requires you to report on your tax return. According to Forbes, many taxpayers overlook income from sources like hobbies, garage sales, odd jobs, and even small lottery ticket winnings. This oversight could cost you interest and penalties if the IRS audits you. In the eyes of the IRS, all income is taxable. Surprisingly, that income does not have to come in the form of … [Read more...]